Digging Into Brazil

Portfolio Manager Alex Zarechnak explains how Brazil is positioned to offer investors renewed growth opportunities—and not just in commodities.

What are the three things that make Brazil a key component of an emerging markets portfolio?

First of all, Brazil is arguably the biggest winner from the commodity boom that we're seeing right now and we think general tightness in commodity markets may continue.

Secondly, while there are always political risks in Brazil, we feel the upcoming presidential elections in October won’t present significant threats to economic stability as the two leading candidates—while they do have flaws—are experienced politicians with track records as national presidents.

Thirdly, the Brazilian equity market is very deep—we believe it’s full of high quality, attractive companies. Our focus is on finding great companies and getting to know them at a detailed level.

Talk to us about Brazil’s commodity strengths?

We thought the Brazilian commodity market was tight even before the invasion of Ukraine and we don’t see significant supply increases coming anytime soon. A lot of commodity companies have been focused on cashflows and returning cash to shareholders and it can take time for those strategies to change.

Even if these companies were to ramp up production in the short term there are some pretty serious obstacles, including physical constraints, environmental opposition and legal challenges. So we think commodity pricing could be strong for a while and Brazil is very well positioned for this trend.

Photo credit: Brazil.tm

And beyond commodities?

Brazil is a broad market and a very entrepreneurial country. In the last six or seven years, it has seen a surge in initial public offerings (IPO). We’ve seen this across a range of industries, including fintech, health care, industrials and software. It’s a rich hunting ground for us.

Most of the entrepreneurial energy has been focused on Brazil’s large domestic market, in particular its middle class which exploded over the last 20 years. Health-care providers are an example of the beneficiaries of this environment. Some players in this sector own hospitals and provide health insurance, instilling an internal incentive to manage hospitals efficiently and lower costs and thereby providing insurance at reduced rates.

What about valuations?

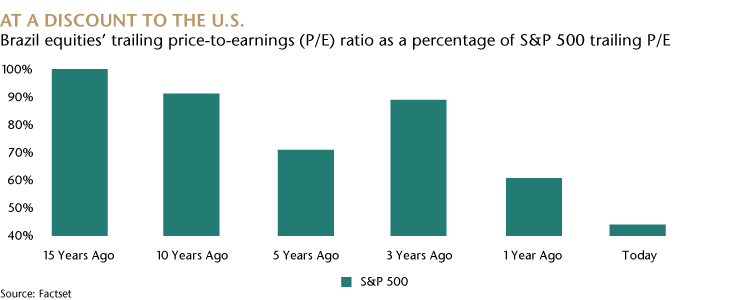

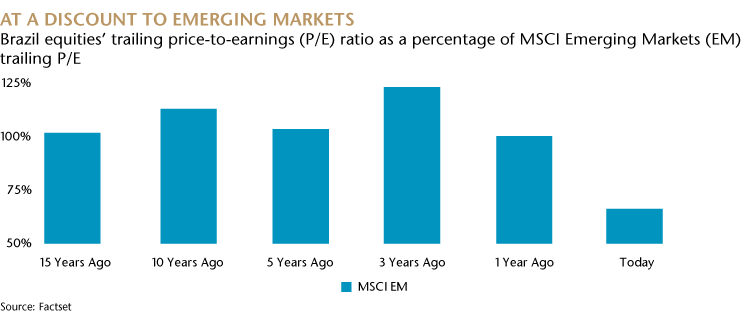

Brazilian companies are attractively valued. Brazil equities have a trailing price-to-earnings (P/E) ratio average discount versus the S&P 500 Index of more than 50%. Over the course of the last five years, that discount has been around 30%. Brazil equities are also at a P/E discount to emerging market equities. So the market doesn’t appear to have yet appreciated all the positives that we see in Brazil.

What do you think will be the tailwinds and the challenges for Brazilian equities over the next 12 months?

Brazil markets are always subject to a range of influences, which can include domestic and global economic cycles, and local political developments. Global commodity prices and the value of the U.S. dollar are also important economic variables for Brazil. As in many countries, inflation has spiked in Brazil but we believe it should end the year considerably lower than today. And this fall, Brazil will elect its president. Passions can run high in presidential elections and surprises can appear. However, as mentioned above, it’s unlikely that either candidate would derail the investment case which underlies our Brazil strategy.

Definitions:

Trailing price-to-earnings (P/E) ratio: P/E ratios relate a company's share price to its earnings per share (EPS). Trailing P/E uses past performance by dividing the current share price by total EPS earnings over the past 12 months.

Standard & Poor's (S&P) 500 Index: The S&P 500 is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

MSCI Emerging Markets (EM) Index: The MSCI EM Index is a selection of stocks that aims to follow the financial performance of key companies in fast-growing countries.