India

The structural growth story and the long-term investment opportunity.

Overview

India’s equity markets are being driven by fundamentals in the form of robust economic expansion which is leading to strong earnings growth. India is also, helpfully, in the draft of favorable geopolitical tailwinds. In this paper, we make the case for India—not as the potential new China or as potentially one of the best-performing equity markets of 2024—but for its own long-term structural growth prospects. We also explain why an active approach is needed to get the best out of India, to capture quality, navigate the challenges, and manage macro variables like inflation, interest rates and global economic growth.

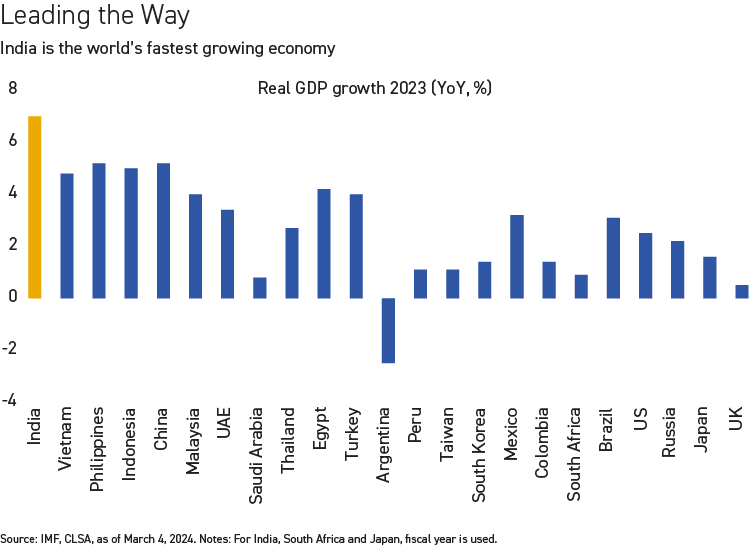

It's hard to stay out of the way of India. It’s been the fastest-growing economy for the past decade and is the fifth largest globally1, behind only the U.S., China, Germany and Japan. The biggest muscle in India’s economy, we would argue, is its domestic market which is powered by a working population that represent two thirds of India’s overall population which is itself the biggest in the world.

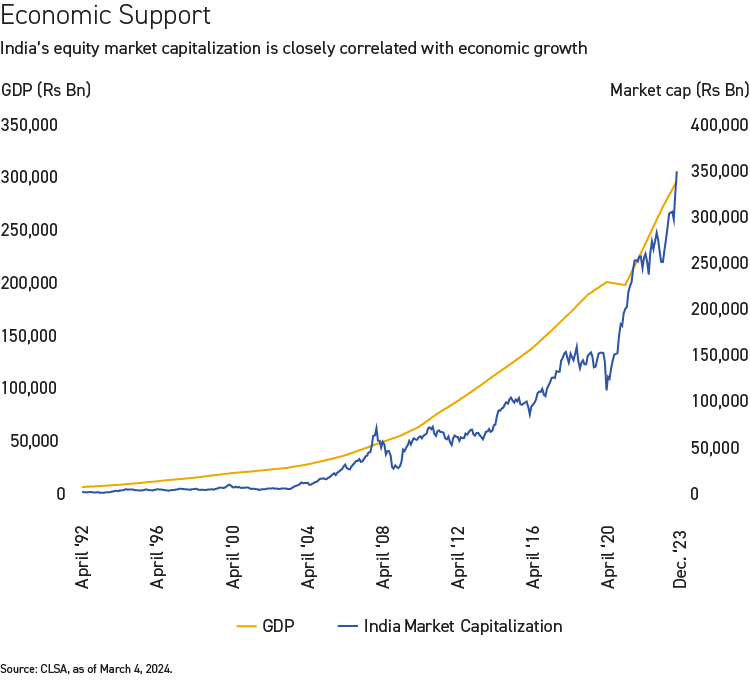

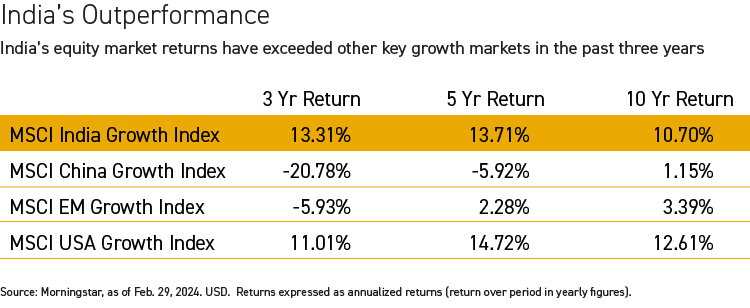

The performance of India’s stock markets reflects its economic growth. Indian equities have been the best performing market for the past three years, and over five and 10 years they have been on the coat tails of U.S. equities. Over all three periods, India’s equity market has outperformed China and emerging markets generally, and its market capitalization is the fourth-biggest in the world1.

To understand India’s economic growth and gauge perspective on how sustainable it may be, we need to look at the forces behind it. In our view, India is being propelled by robust demand and robust supply—and at a scale that is unique among major international markets.

Drivers of change

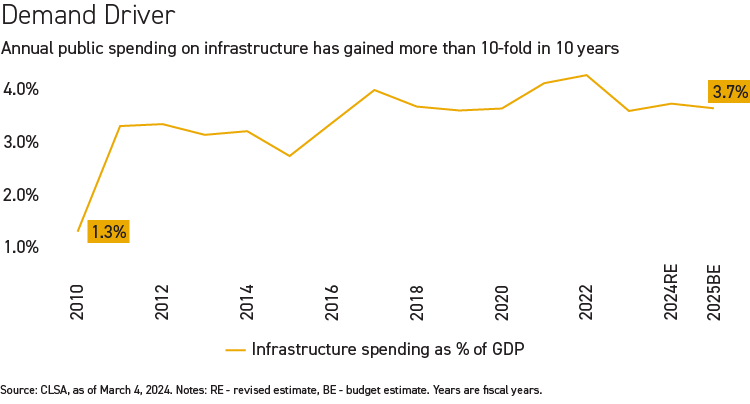

Until relatively recently, India’s economy was powered largely by consumption in the form of demand for basic consumer staples, and by agriculture and industries ranging from health care to outsourcing and professional services, like IT, legal, accounting and consulting. This posture provided little scope for India to develop its own manufacturing and industrial capability; regulation and red tape were added disincentives. The bottom line for investors was that India couldn’t be ignored but at the same time its long-term growth path was hard to predict. That’s changed. Over the past decade, India’s consumption and production engines have been transitioning and expanding. The forces of demand have been strengthened by big increases in government spending, particularly on infrastructure. Over the past 10 years, the government has spent around US$800 billion on bridges, roads and rail and other construction projects, averaging around 3.6% of GDP1, and under Prime Minister Modi—provided he is re-elected this year—that cadence looks likely to continue.

“Public spending and the government’s pro-business reforms have lit a fuse under India’s entrepreneurial culture and are driving a domestic growth agenda.”

This infrastructural program has led to heavy investing in fixed capital goods like factories, equipment and manufacturing. And as more wealth has been generated in the domestic economy, there has been a trickle-down of higher disposable income among parts of India’s working population which has led to more demand for higher value consumer goods and big-ticket items like autos. This trickle-down is only at the beginning. We believe the impact of infrastructural and other spending will lead to a long term and broad pickup in domestic consumption across the economy. Exports have also increased, by around 35% over 10 years through 20221, supported by demand for pharmaceuticals, materials and industrial engineering goods like rail rolling stock.

Domestic Hubs

Some Key Areas of Manufacturing, Renewable Energy and Technology Activity in India

Source: Matthews. Notes: Cities highlighted show locations where there is a local focus on manufacturing, renewable energy, or technology.

Over the same period, the forces of supply have gathered strength. India’s manufacturing capability has been boosted by government reforms like tax cuts, incentives associated with its “Make in India” policy, and ongoing changes to housing, land and labor laws. There have also been changes in monetary policy with the aim of maintaining price stability; a pledge to reduce the fiscal deficit and make public spending more efficient; and the digitalization of India’s data infrastructure. All have made doing business in India easier and aided its expansion.

This pro-business platform has led to increased corporate capital expenditure and rapid expansion in areas including materials, industrials and manufacturing, like aerospace and electronics. It has also successfully encouraged foreign investment. Multinational companies, like engineering firms ABB and Siemens, Apple and semiconductor makers Micron Technology and Renesas Electronics, are setting up operations in India to manufacture their goods and to sell into India’s domestic market.

India plus zero

Some observers have attributed a large element of India’s recent growth to the challenges of China which have undoubtedly encouraged companies with operations in China to leave and move to more benign business environments. We would argue that India’s increasing appeal to overseas investors is a side effect of its domestic growth agenda rather than a manifestation of overseas China Plus One strategies. Foreign companies are attracted by India’s skilled labor force, which is cheaper than China’s, and the opportunities that its expanding manufacturing and consumer base provide. So while some companies have moved operations to India because of geopolitical concerns in China, in many instances, India’s strengths have been the stronger pulls.

“India is not China and its associated political tensions and it’s not South Korea and its associated cyclical dependency on the U.S. tech supply chain.”

One thing is certain, in our view, India today is a much bigger and more-rounded economy than it has ever been. Public spending and the government’s pro-business reforms have together, we believe, lit a fuse under India’s renowned entrepreneurial culture and are driving the domestic economic agenda and, importantly, helping to shift India’s destiny into its own hands.

The active approach and being selective

Understanding these high level drivers in India’s economy is key to helping investors identify areas of long-term sustainable growth. We also believe that India is not a thematic, cyclical market. If we try to focus on a potential sub-trend or an industry without seeing the bigger direction of economic travel in India, we risk overlooking the companies that are best positioned to grow in this environment.

For us, India is a structural growth story and the earnings of its companies are strongly tied to economic growth. Of course, growth comes with a price. By and large, Indian equites are expensive, particularly in sectors like consumer staples, and in the mid- and small-cap markets where increased volatility is encouraging us to lean more to the greater predictability of the large-cap market. For the past 10 years, India’s earnings multiples have on average been at a 57% premium to emerging markets.1

To get the most from India, we have to be selective. We look in the areas where we have confidence, for example, in the companies and industries at the tip of the structural momentum in India like industrials and manufacturing. We look for quality, at fundamentals: profit growth, the cash flow, business models. Then we look at the price and we endeavor to keep a close relation between earnings projections and earnings multiples.

These variables come into play in different ways depending on the company and the sector. For example, for a young company with growth potential we’d put a larger focus on its cash flow and business model; in contrast, for an established business we look more at payout ratios and efficiencies, as well as profitability.

It’s also worth pointing out that, while many valuations are at elevated levels, the positive is the economic growth underpinning India’s equity markets. If we sell a holding because we believe its growth potential is too out of line with its valuation we know there are other growth opportunities in the market with better pricing. This illustrates what we believe to be the edge that active investing has over passive investing, or “set-and-forget” portfolios, in India and in emerging markets generally.

The opportunity ahead

So what kind of market growth and investment returns might we expect going forward? The NIFTY 50, which tracks India’s biggest public companies by market capitalization, delivered an impressive compound annual growth rate (CAGR) of 14% over the last decade even though it was only in the last three years that earnings growth was robust2. If earnings growth surprises positively this year and next, we believe market returns could be higher with the possibility of multiples even getting re-rated.

“We have to be selective. We look for quality, at fundamentals like profit growth, cash flow and business model. Then we look at the price and we seek a close relation between earnings projections and earnings multiples.”

While the prospects are promising we would stress that India is in a very different place to where it was even five years ago and its journey is evolving. Following an index may have been a good strategy in the past but we don’t necessarily think that all boats will continue to rise on a sustainable basis. India’s equity benchmarks, in our view, increasingly reflect the “older India” as we call it, one that was more rooted in commodities and consumer staples. Some of these companies, particularly in the consumer staples sector, have elevated valuations in spite of their low growth potential. In contrast, newer areas of growth, like industrials and manufacturing, are under represented by benchmarks, we believe. As active managers, we can give these sectors a greater focus in our portfolios while still being cognizant to those companies and sectors generally which are benefiting from India’s structural growth, like financials and health care and utilities.

“Older India is increasingly reflected in passive benchmarks. As active managers we believe more exposure to new India sectors will underpin long-term returns.”

New and the Old

Actively hunting for opportunities close to and further away from popular investment areas is key to getting the best from India

Old India

New India

In Summary and Conclusion

India is an economic power house on the world stage but it is still India. While the country is firmly embracing new technology and generating high levels of growth, it still has the hallmarks of a developing country. A bad monsoon season can be devastating for India’s agricultural sector which remains a big contributor to its economy.

At the same time, India is not China and its associated political tensions and India is not South Korea and its associated cyclical dependency on the U.S. tech supply chain. India’s growth story is evolving and the drivers of growth are deep. Its markets are planted on a bedrock of economic strength that is increasingly driven by domestic growth and increasingly sheltered from the fortunes of the world economy. To get the best from India, investor allocations need to be actively managed and anchored and connected to the drivers of change in its economy.

Sectors and Secular Themes

We focus on identifying both growthier stocks and more value stocks and on avoiding sub-quality companies. We like manufacturing and industrials, health care, real estate, financial services and consumer discretionary sectors, as we believe they will both support and be beneficiaries of growth in the Indian economy in the medium and long term.

Manufacturing and Industrials

Manufacturing and industrials is a sector, in our view, that will continue to see tailwinds from government incentives and public spending and be aided by geopolitical factors in the medium term as overseas companies seek hubs or relocate units outside of China. As India becomes less dependent on imports and exports continue to increase, manufacturing and industrials will grow in leaps and bounds for the next decade, we believe. The government’s focus on improving infrastructure, India’s high share of working age population, the continuous upskilling of the labor force and use of automation and artificial intelligence (AI) in manufacturing processes will be further enablers for the growth. There has been added momentum to this sector in recent years and we see it as a secular growth area.

Health Care

In this sector, contract development and manufacturing organizations are seeing secular tailwinds as overseas companies deepen partnerships with Indian companies and increase activity in the country. And the pharmaceutical sector is seeing cyclical upturn in the U.S. generic market. Indian pharma companies are also moving up the product complexity and innovation chain which helps this sector’s long-term growth. We have been cognizant of the structural opportunities in this space as well as the cyclical opportunities when they have presented themselves. Currently, as a coincidence, there is a confluence of both structural and cyclical positives.

Financial Services

Financial services is a sector we think will do well over the longer term albeit with some near-term liquidity headwinds. Credit growth has been an enabler of India’s economy growth and various banks and non-bank financial institutions have supported this. Outside of funding major areas of economic growth, this sector has played an important role in serving the credit needs of bottom of the pyramid households as well as smaller businesses, startups and venture firms, which is essential for the broad-based growth of the economy. Robust data collection, and digitization of various internal and consumer-facing processes, has made the sector much more efficient. India remains a credit-underpenetrated market so we think financial services is a significant long-term secular story.

Consumer Discretionary

We believe India is at an inflection point whereby domestic purchasing power will increase significantly and this will lead to very strong growth in consumption. We are firm believers in India’s consumption potential and are more confident there will be stronger growth at the higher value end and think premiumization will be a distinct secular trend for the next decade.

Real Estate and Hotels

Real estate and hotels are going through a major upcycle at the moment. We think there are secular themes and opportunities particularly in India’s residential real estate market where home ownership is increasing and sales are robust. This expansion is being driven by increases in per capita GDP and accumulating individual wealth. Upgrading and value enhancing of properties is commonplace in urban areas where we also see strong growth in subsectors like luxury apartments. India’s real estate sector has a long runway of opportunity, in our view.

IT and Consumer Staples

IT and consumer staples have been facing demand headwinds for quite some time and we don’t have the visibility of a bounce-back yet. Also, valuations don’t quite reflect the stress in these sectors and the risk-reward in many cases doesn’t seem justified, in our view. However, these areas include great quality, large companies which are considered defensive, especially in volatile times, so they always merit review.

Sources: 1CLSA, as of Feb. 27, 2024; 2Bloomberg, as of March 17, 2024

Notes: The information on the security mentioned above is presented solely for illustrative purposes and is not representative of the results of any particular security or product.